Netflix losses: The streaming giant’s biggest threat is competitors are catching up

Netflix is having a miserable year. The streaming giant shed 200,000 subscribers in the first quarter of 2022 — its first loss in more than a decade — and dropped around 1 million more in quarter two.

The company’s woes have sparked concerns that video streaming is dying, but research suggests that there’s plenty of life left in the sector.

A May study by Hub Entertainment Research estimated that 89% of US consumers subscribed to one in streaming service in 2022 — an 11% increase on the previous year.

Greetings, tech nerd!

Are you into gadgets? And apps? And other cool tech stuff? Then this weekly newsletter is for you.

“Netflix’s subscriber loss in Q1 of 2022, and its anticipated losses in the following quarters, represent a tiny proportion of its global subscriber base,” said study co-author Peter Fondulas.

“And in fact, at some point, a service as widely penetrated as Netflix has only so much room left to grow. In our view, it would be a grave mistake to take the Netflix experience as a sign that streaming TV services are on the verge of decline, as some analysts have suggested.”

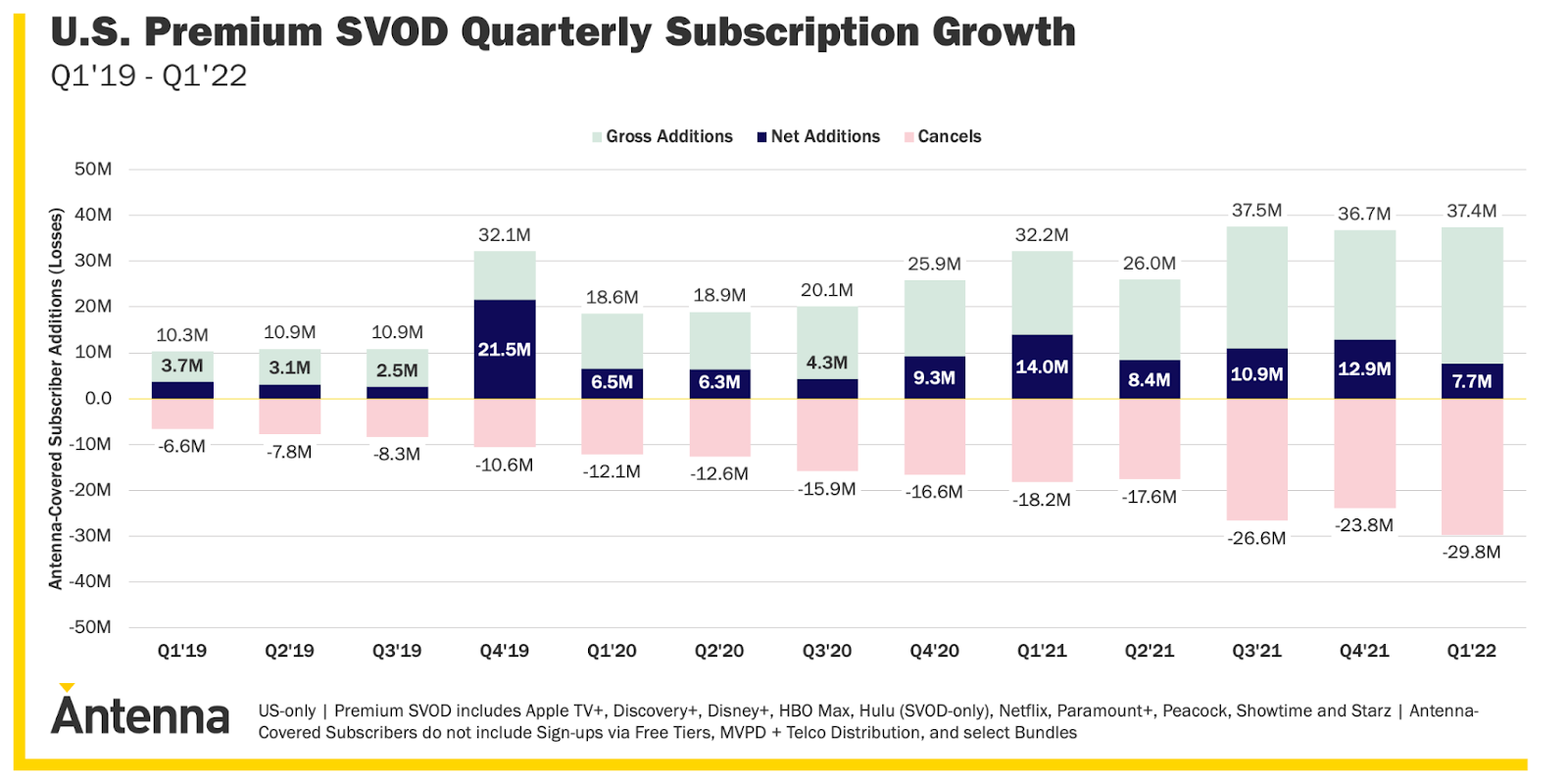

Other studies have discovered further grounds for optimism. Antenna, for instance, found that first-quarter US subscriptions in the Premium SVOD (subscription video on demand) category rose 4% quarter-on-quarter and 25% year-on-year — despite Netflix’s losses.

Zuora, a subscription software vendor, has also released upbeat data. The company found that the monthly churn rates among its customers are lower than pre-pandemic levels — decreasing 19% compared to three years ago (March-May 2019 to March-May 2022), and 11% in just the final three months.

A March survey by Deloitte, meanwhile, found that the average churn rate in the US has remained consistent since 2020 at 37%.

None of this means that all is rosy at Netflix. The company’s user base has been depleted by pulling the service in Russia, a cost-of-living crisis, the use of shared accounts, and a recent price increase.

Yet many analysts believe the biggest issue is the rise of Netflix rivals.

Netflix is now the one being disrupted.

Competitors including Disney, Amazon, HBO Max, and Apple are now catching up on the pacesetter.

Disney+, for instance, added 7.9 million paid customers in the first three months of 2022, while HBO and HBO Max ended March with 3 million more subscribers than at the end of last year.

Netflix users, meanwhile, appear increasingly unhappy with the streaming service. A recent survey by tech entertainment firm Whip found that Netflix has dropped from number two in the industry for customer satisfaction in 2021 to fourth this year. The company now ranks behind HBO Max, Disney+, and Hulu.

Consumers now face an overload of choice at a time of tightening household budgets — and some are ditching Netflix for its rivals.

“Netflix once disrupted the entertainment space but is now the one being disrupted by competitive streaming platforms that have been aggressively scaling up,” said Forrester VP and Research Director Mike Proulx in a statement last week.

The growing competition has led Netflix to reverse its stance against ads. This month, the platform revealed that it’s partnered with Microsoft to introduce a lower-priced, ad-supported subscription plan.

They have to focus on keeping their current subscribers coming back.

Research suggests that the move could prove successful. A December survey from Forrester found that 43% of US online adults who use a streaming service are concerned with how much they’re paying — and 44% will accept ads if it means they pay less.

The company has also unveiled plans to crack on password sharing. But Tien Tzuo, the CEO and founder of Zuora, argues that further changes are needed.

“They are still the king of streaming, but to continue to lead, they can’t just focus on subscriber acquisition, they have to focus on keeping their current subscribers coming back,” he said.

“Beyond more shows, Netflix should rethink the binge, offer annual plans, and unbundle their content to create smaller, cheaper (and ad-free) offerings.”

Such moves could boost Netflix’s user base — but rivals are also improving their product offerings.

Consumers could reap the benefits of this competition. Netflix, however, faces further threats to its market lead.

HT: TV Tech